Table of Content

Neither VALoans.com, Mortgage Research Center nor ICB Solutions are endorsed by, sponsored by or affiliated with the Dept. of Veterans Affairs or any other government agency. If you submit your information on this site, one or more of these companies will contact you with additional information regarding your request. By submitting your information you agree Mortgage Research Center can provide your information to one of these companies, who will then contact you.

Again, they’re not required to pay any of them, so this will always be a product of negotiation between buyer and seller. It's not unusual for buyers to work with their agents to negotiate for sellers to pay certain closing costs. Buyers can ask the seller outright to pay these costs and fees from the sale proceeds.

Survey Fee

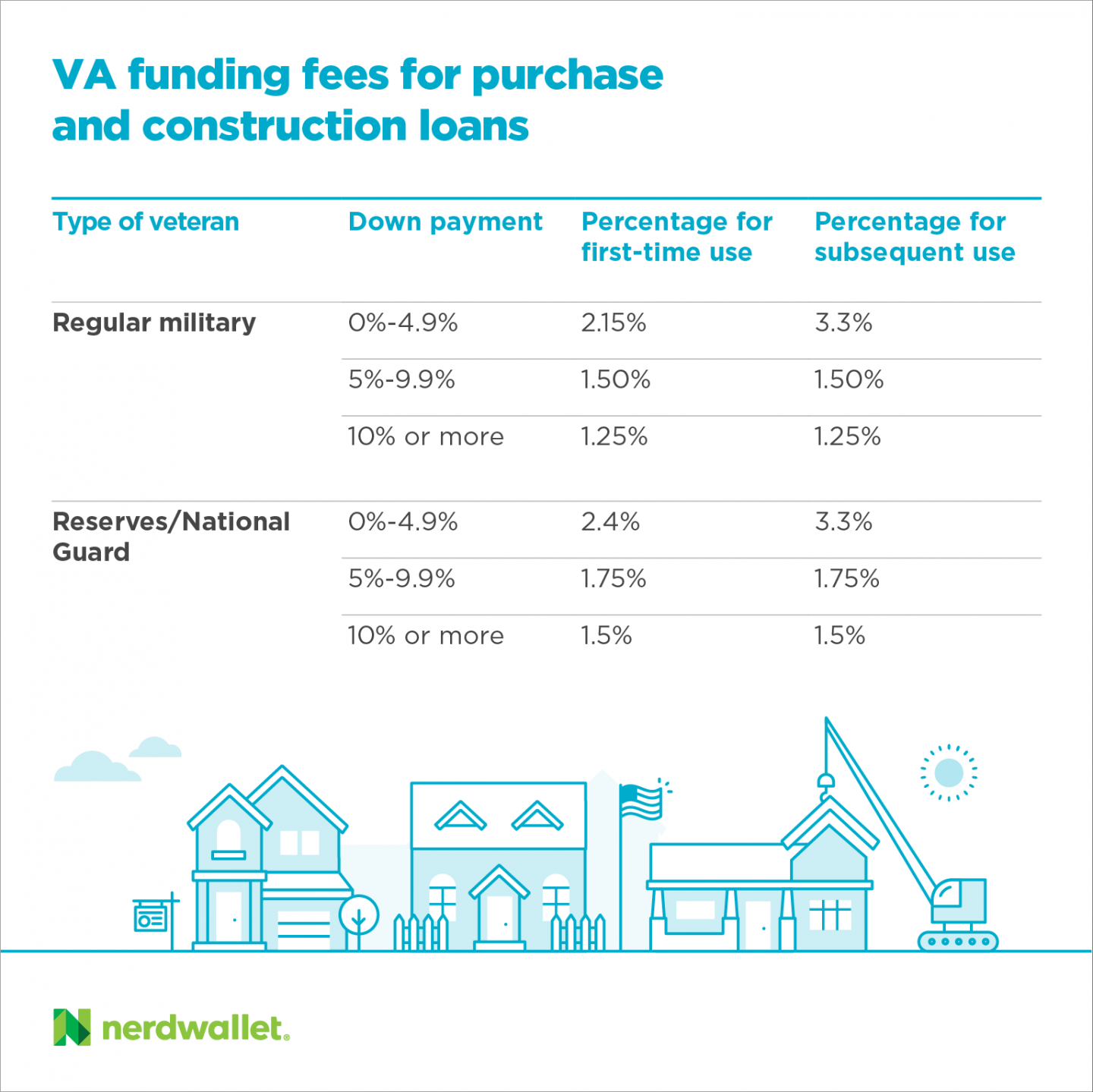

Down payment and VA funding fee amounts are expressed as a percentage of total loan amount. You may be eligible for a refund of the VA funding fee if you’re later awarded VA compensation for a service-connected disability. The effective date of your VA compensation must be retroactive to before the date of your loan closing.

It’s also an excellent vehicle for Veterans who want to get out of an adjustable-rate VA mortgage. Ongoing dues can range from as little as $100 a year to thousands of dollars a year, depending on the services and amenities your HOA pays for. One-time initiation fees can range from $100 to a whole year’s dues. You may also be able to use gift funds from a family member or close relation. There may be a fee involved with obtaining a home warranty on a property.

Bankrate

Closing Cost Description Real Estate Agent Commission If real estate agents were involved in your homebuying process, their commission will need to be paid at closing. In most cases, all agent commissions will be paid for by the seller. At closing, you'll build up that escrow account by prepaying your estimated property taxes.

Essentially, closing costs are the fees you pay to the lender for their assistance in creating and servicing your loan. While VA closing costs include a range of fees similar to other loans, the VA funding fee is specific to VA home loans. It’s a fee that covers the possibility of the loan not getting repaid—ranging from 1.4% to 3.6%. When you’re shopping for a refinance, more than likely, you’ll focus on comparing interest rates between lenders.

Are closing costs different for a VA purchase versus a VA refinance?

This money “primes the pump” so to speak so that when your property taxes and insurance come due, there’s enough in reserve to pay them. The lender requires this prepayment because they want to make sure any damage done to the home will be repaired. Homeowner’s insurance is just like any insurance policy — it renews every year and will need to be paid again each year. This is an ongoing insurance policy, paid every year, on any home that is located inside a flood zone. The lender requires the home to be insured against flooding, which is not covered by the standard homeowner’s insurance policy. We’ll take a closer look at the various types of closing costs in the next section.

VA construction loans are available for qualified military borrowers who want to build homes. Here’s what you need to know about whether it’s possible to use a VA loan for a second home purchase. We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy. Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

VA home loan programs for surviving spouses

There might also be some closing cost and down payment assistance programs available at the state level specifically for veterans. Some cities and counties offer programs of their own, as well. When you use a VA loan, there are limits on the fees that lenders can charge. For example, instead of paying your earnest money directly to the buyer, you’ll pay the escrow company. At the right time, the escrow service will forward your payment onto the buyer. The Department of Veterans Affairs seeks to protect VA homebuyers from exorbitant fees.

Talk with your real estate agent and your lender about your options. You may be able to increase your purchase offer by the amount of your closing costs. For example, let’s say you’re buying at $150,000 and your closing costs are $5,000. You may be able to increase your offer to $155,000 and have the seller use those proceeds to cover your closing costs.

These policies will often cover the cost of certain repairs during the first year you own the home. Some lenders may charge a fee for accessing your credit information. Learn how VA-backed and VA direct home loans work—and find out which loan program might be right for you. We’ll calculate your funding fee as a percentage of your total loan amount.

Some lenders specialize in VA loans and may offer special incentives toward your costs to earn your business. VA loans are designed to provide affordable mortgage financing options to military service members. There are some unique differences between VA closing costs and closing costs you’d normally pay with a conventional mortgage or one backed by the Federal Housing Administration . You should expect to pay $425 – $875 for a VA appraisal fee, which will be included in the closing costs.

Depending on the market, the seller may choose to pay additional closing costs. If a home you’re interested in has been on the market for a while or you’re house shopping in a buyer’s market, it could be worth negotiating with the seller. To keep VA borrowers from being overcharged, lenders cannot charge an origination fee equal to more than 1% of the total loan amount. You’ll pay a lower VA funding fee the first time you use your VA mortgage benefits. The fee goes up for every subsequent no down payment or VA refinance loan you take out.

No comments:

Post a Comment